Flexible Spending

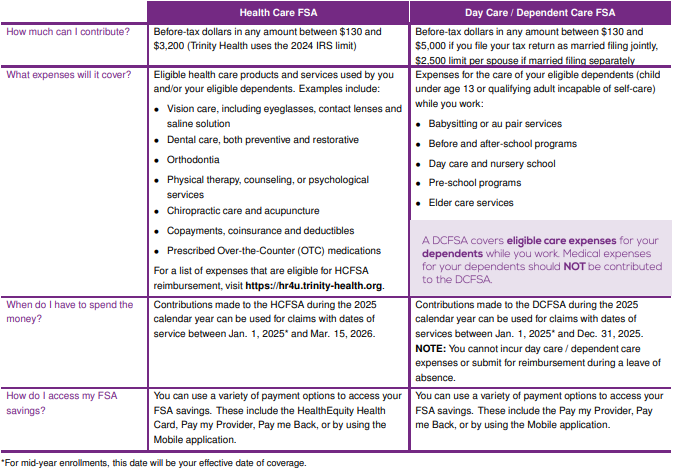

You have the opportunity to set aside before-tax money to offset eligible health care or dependent care expenses. There are two different types of Flexible Spending Accounts – a Health Care Flexible Spending Account and a Dependent Care Flexible Spending Account.

2026 FSA Information

- Health Care Dependent FSA (HCFSA) Contribution Limit: $3,300

- Dependent Care FSA (DCFSA) Contribution Limit: $6,000

2025 FSA Information

- Health Care Dependent FSA (HCFSA) Contribution Limit: $3,200

- Dependent Care FSA (DCFSA) Contribution Limit: $5,000

Helpful Information

- Health Care Flexible Spending Account Claim Form

- Dependent Care Flexible Spending Account Claim Form

- WageWorks EZ Receipts

- Full List of Expenses

- WageWorks Site

- About Flexible Spending Accounts (short video)

Reminders:

- If you choose to enroll in the Health Savings Plan option, you cannot enroll in the HCFSA. The Health Savings Account works just like the HCFSA but offers additional benefits, such as the opportunity to carry over unused funds, contribute up to $4,300/individual* ($8,550/family) for Plan Year 2025, plus an additional $1,000 in catch-up contributions if you are age 55 or over, and earn interest on your savings. For Plan Year 2026, you can contribute up to $4,400/individual ($8,750/family), plus an additional $1,000 if you are age 55 or over.

- You must make health care and/or dependent care spending account elections each year during open enrollment. Your prior year elections will NOT carry forward.

- HCFSA and DCFSA claims for the 2025 plan year must be postmarked on or before Mar. 31, 2026.

- If you choose to contribute to the HCFSA for the first time in 2026, a new Health Equity Health Card will be mailed to your home. Otherwise, you will only receive a new Health Card when your current card expires.

Take Advantage of WageWorks Mobile Site

As the nation's largest independent provider of consumer-directed benefit solutions, WageWorks offers FSA participants the latest technology to make it easier to manage your savings. Their mobile site and new EZ Receipts app offer the following features:

- Check your current HCFSA and DCFSA account balances

- Submit HCFSA and DCFSA claims

- Submit WageWorks Health Care card receipts